Incoterms have been made and published by the International Chamber of Commerce (ICC) in Paris. One of the tasks of the ICC is to make it easier for companies in different countries to trade which each other. Incoterms are accepted world-wide. The present edition of Incoterms is dated 2020.

The ICC notes that the Incoterms® rules have become an essential part of the daily language of trade and that they have been incorporated in contracts for the sale of goods worldwide and provide rules and guidance to importers, exporters, lawyers, transporters, insurers and students of international trade.

Incoterms shall in particular avoid misunderstandings between the parties to the contract and make international trade easier. The Incoterms qualify general trade terms which are most commonly used in international sales contracts. Incoterms are frequently adopted by the parties of an international sales contract, somtimes also incorporated in construction contracts.

The existing Incoterms cover different areas. The adoption of any of the trade terms indicates at which point the delivery of the goods shall take place. But each one works different from the other one´s. The official ICC website publishes the Preambles to each term in read-only format, together with basic information and background. The Preambles do not spell out the obligations of buyer and seller, which are essential to the correct use of Incoterms.

This information may be obtained by consulting the full published texts of the existing Incoterms, available from ICC Publishing and ICC national committees throughout the world.

INCOTERMS 2000

| EXW (Ex Works) | |

| FCA (Free Carrier) | |

| FAS (Free Alongside Ship) | |

| FOB (Free On Board) | |

| CFR (Cost and Freight) | |

| CIF (Cost, Insurance and Freight) | |

| CPT (Carriage Paid To) | |

| CIP (Carriage and Insurance Paid To) | |

| DAF (Delivered At Frontier) | |

| DES (Delivered Ex Ship) | |

| DEQ (Delivered Ex Quay Duty Paid) | |

| DDU (Delivered Duty Unpaid) | |

| DDP (Delivered Duty Paid) |

INCOTERMS 2010

| EXW (Ex Works) | |

| FCA (Free Carrier) | |

| FAS (Free Alongside Ship) | |

| FOB (Free On Board) | |

| CFR (Cost and Freight) | |

| CIF (Cost, Insurance and Freight) | |

| CPT (Carriage Paid To) | |

| CIP (Carriage and Insurance Paid To) | |

| DAT (Delivered At Terminal) | |

| DAP (Delivered At Place) | |

| DDP (Delivered Duty Paid) | |

The update 2010 came into force on 1 January 2011. As shown in the table above in 2010 the ICC has added new terms (DAT and DAP) and has eliminated existing terms (DAF, DES, DEQ, DDU).

Some INCOTERMS (including the 2 new ones) shall be explained in a nutshell below:

FOB (“Free On Board”)

In a FOB contract it will be the duty of the seller to place the goods over the ship´s rail and to deposit them on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. When the goods have arrived on board of the vessel the risk of risk of loss of or damage to the goods passes to the purchaser.

CIF (Cost, Insurance and Freight)

In a CIF contract the seller has to perform the contract by delivery of the shipping documents to the buyer. Also pursunt ot CIF the risk of loss of or damage to the goods passes to the purchaser when the goods have arrived on board of the vessel the risk of risk.

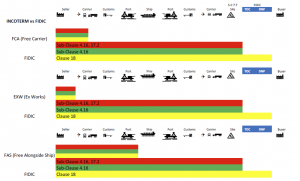

FCA (“Free Carrier”)

In a FCA contract the seller undertakes to deliver the contract products cleared for export, to the carrier nominated by the buyer at the namend place. It is crucial to Name the place of delivery exactly and without ambiguity.

DAT (“Delivered At Terminal”)

DAP (“Delivered At Place”)

In a DAP contract the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport provided that they are ready for unloading at the named place of destination.

The ICC was pleased to announce the publication of Incoterms® 2020, as ICC clebrated its Centenary in 2019.

INCOTERMS 2010

| EXW (Ex Works) | |

| FCA (Free Carrier) | |

| FAS (Free Alongside Ship) | |

| FOB (Free On Board) | |

| CFR (Cost and Freight) | |

| CIF (Cost, Insurance and Freight) | |

| CPT (Carriage Paid To) | |

| CIP (Carriage and Insurance Paid To) | |

| DAP (Delivered At Place) | |

| DPU (Delivered At Place Unloaded) | |

| DDP (Delivered Duty Paid) | |

The structure and classification of the Incoterms 2020 correspond to the Incoterms 2010. The 2010 clause DAT (Delivered Terminal) has been changed to DPU (Delivered at place unloaded)

When a contract is made between persons or companies residing in different countries the question arises by which law the contract is governed. Different rules (as to capacity, formalities, etc.) apply in order to determine the applicable law. Concerning essential vailidity, interpretation and performance the contract is governed by the proper law of the contract. The parties may choice the law applicable to their contract. When there is no stipulation the proper law is the law with which the contract has the closest connection. It is presumed that the contract is most closely connected with the country in which the party who is to effect the caracteristic performance of the contract has is habitual residence (Art. 4 EEC Convention on private international law). In an international sales contract this would be the law of the seller. Under the EU Rome I Regulation anyway the law of the seller prevails.

Users should therefore never forget, that the Incoterms are applied and construed by national Courts or Arbitration Tribunals who may understand a term in a different way that the term will be understood in the purchasers country. Incoterms have to be incorporated into national law systems because they only direct some special aspects of a contract. Nowadays Incoterms are more frequently combined with the UN sales convention (CISG), promoted by UNCITRAL on April 11th, 1980 which has come into operation in 1991 and which is a part of German substantial law. Therefore the UN Sales Convention apply to each international sales contract if German law is the proper law of the contract, what will be presumed if the seller has his habitual residence in Germany. The parties may exclude the application of this Convention, but they have to do it expressly.

In Germany Incoterms are accepted as general trade terms (Allgemeine Geschäftsbedingungen). Incoterms apply to sales contracts only if the parties have agreed on them. German courts may review the terms. The German Unfair Contract Terms Act has been incorporated in the German Civil Code (BGB). Though normally qualified as commercial contracts International Trade Terms like INCOTERMS are, as such, not fully exempt from the operation of the Unfair Contract Terms regulations. Notably Section 307 German Civil Code applies.

For foreign companies who like to sell goods to a German contractor it might be interesting to know that Germany accepts retention of title clauses as a guarantee for payment. A retention of title clause is valid if there is a written agreement on it. The following clause might be recommended:

Goods sold remain property of the vendor until complete payment by the purchaser.

Under German law there are more sophisticated retention of title clauses than this. Several types of retention of title clauses exist in order to extend retention of title (for example if the buyer sells the goods to another buyer). Quite often retention of title is combined with an assignment clause, by which the purchaser assigns his entitlement to payment in the event of any resale to a customer to the producer or first seller.

In case of insolvency of the buyer the seller is entitled to ask the insolvency-administrator to give back the delivered goods if they still exist in nature. Stipulations on retention of title therefore are very important and frequently used in Germany.

If it is intended to use Incoterms under FIDIC terms and conditions care must be applied in order to avoid issues. Usually FIDIC forms of contract already establish a comprehensive set of clauses and provisions which are needed in a construction context. Users should definitely acquaint themselves with Sub-Clauses 7.7, 17.2 FIDIC Rainbow Edition, 1999 or Sub-Clauses 7.7, 17.1 FIDIC Rainbow Edition, 2017.

For further information please contact our law firm.

Oldenburgallee 61

14052 Berlin

Tel.: 00 49 (0) 30 3000 760-0

e-mail: ed.ke1745082568oh-rd1745082568@ielz1745082568nak1745082568

https://www.dr-hoek.de